Introduction:

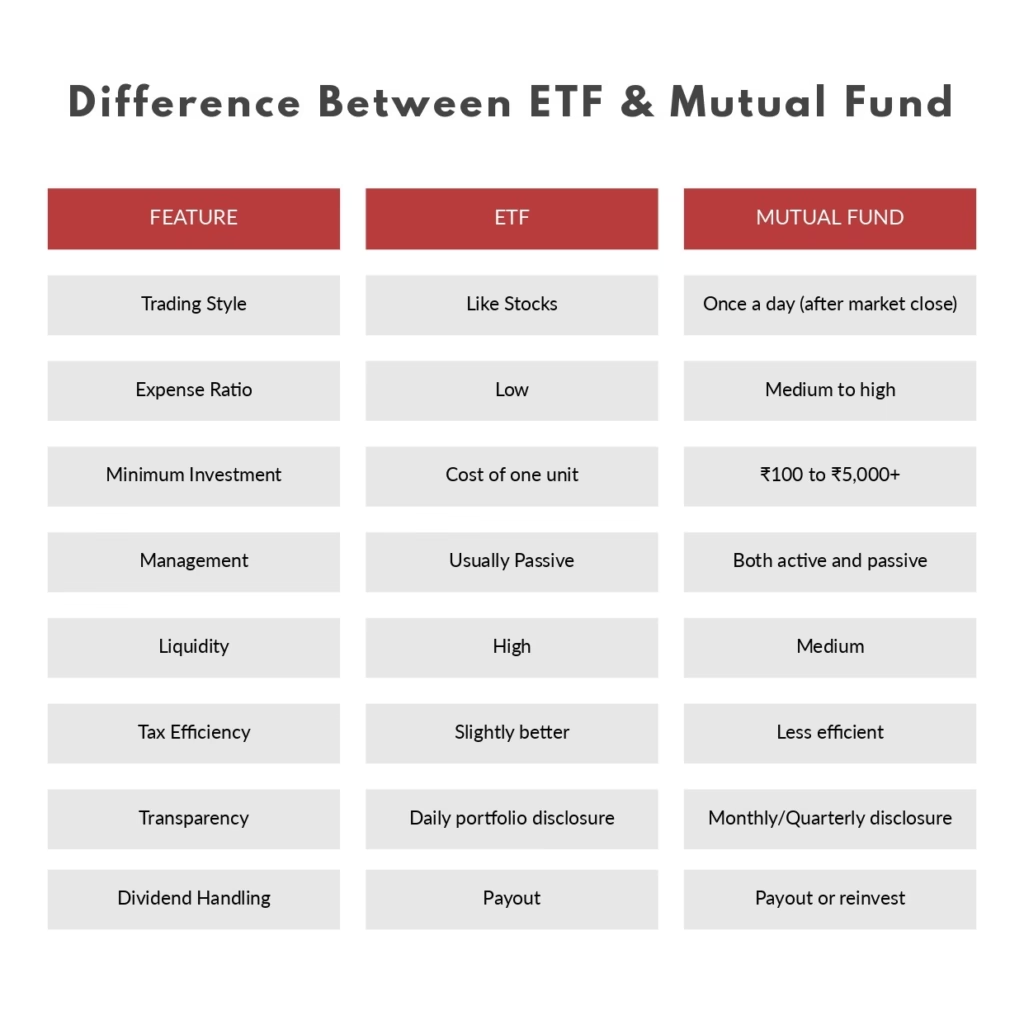

The scale of investment in the stock market is increasing day by day, and one of the decisions that new investors face when it comes to investing in this stock market is to choose between an ETF (Exchange-Traded Fund) and a mutual fund. Both are popular investment vehicles and work quite differently, which helps in diversifying your portfolio. In this article, we will explain the difference between ETF and mutual fund in a relevant, comprehensive, and simple way.

Understanding the differences between these two investment vehicles will help us save on fees, manage risk better, and even make our investments more tax-efficient.

Table of Contents

What is an ETF and a Mutual Fund?

Before we understand the difference between ETF and mutual fund, we need to understand what these two are.

Exchange-Traded Funds (ETFs):

ETFs are investment funds that trade on stock exchanges like individual stocks. ETFs are designed to track the performance of an index, commodity, bond, or a specific sector. ETFs offer the diversification benefits of mutual funds along with the trading flexibility of individual stocks.

For example, NIFTYBEES tracks the performance of the Nifty 50 Index. You can buy and sell ETFs just like you would buy and sell individual stocks during normal market hours. The price of an ETF fluctuates based on supply and demand during market hours.

Mutual Funds:

On the other hand, a mutual fund is an investment vehicle, managed by professional fund managers, that pools funds from many investors to invest in a diversified portfolio of stocks, bonds, and other securities. These fund managers make investment decisions on behalf of the shareholders.

Mutual funds are bought and sold only once, after the market closes at the end of the day. Its price is called NAV (Net Asset Value), which is calculated and updated only once at the end of the trading day.

1. Trading and Liquidity:

The first major difference between ETF and mutual fund is the way they trade.

- ETFs trade like individual stocks. You can buy and sell them during market hours. Based on supply and demand, the price of an ETF fluctuates during market hours. The real-time trading capability of an ETF enhances its liquidity, enabling investors to respond quickly to market changes.

- On the other hand, mutual funds are traded once a day after the market closes. The price of a mutual fund changes only once at the end of the day when the NAV of that mutual fund is calculated. So, when you buy or sell a mutual fund, you don’t know how much you will pay or receive until the transaction is completed.

2. Cost and Expense Ratio:

Another important difference between ETF and mutual fund lies in the cost structure.

- Examining the cost makes the difference between ETFs and mutual funds even clearer. ETFs, which are typically passively managed, have lower expense ratios than actively managed mutual funds. ETFs track an index rather than outperform it, which is why their management fees are lower.

- On the other hand, mutual funds, especially those that are actively managed, typically have higher expense ratios. These higher fees compensate fund managers for their research, analysis, and active portfolio management.

3. Minimum Amount of Investment:

Another important aspect of the difference between ETF and Mutual Fund is the minimum investment amount.

- In case of ETFs, there is no specific minimum investment amount beyond the price of one unit, which makes ETFs acceptable to all types of investors. If one unit of ETF is priced at ₹50, then you can invest ₹50.

- In case of mutual funds, there is a minimum investment amount, which can range from ₹100 to ₹5000 or more. This higher barrier makes mutual funds relatively less accessible to new investors or investors with less capital.

4. Management Style:

The difference between ETF and mutual fund also lies in the management approach.

- Most ETFs are passively managed. They track indices such as the Nifty 50 and the Sensex. This passive approach aims to match the performance of the market rather than outperform it.

- Mutual funds offer both active and passive management. Actively managed mutual funds have professional fund managers who strive to outperform their benchmark index through research and careful security selection. These actively managed funds can generate higher returns, but they come with higher expenses and no guarantee of success.

5. Tax Efficiency:

The difference between ETF and mutual fund extends to how gains are taxed.

- ETFs are generally more tax-efficient than mutual funds. ETFs use an “in-kind redemption” mechanism that allows them to avoid the distribution of most of their capital gains. This means that investors in ETFs only pay taxes on the gains when they sell their shares.

- In the case of mutual funds, when investors sell their shares, a fund manager may have to sell the underlying securities to meet the redemption request, resulting in capital gains that are distributed to all investors, even those who did not sell.

However, in India, both are taxed at the same rate: 20% for short-term capital gains (STCG) and 12.5% for long-term capital gains (LTCG) in the case of equity-oriented schemes.

6. Dividend Handling:

Another difference between ETF and mutual fund is based on how dividends are handled.

- Dividend-paying ETFs usually pay out dividends directly to the investor’s account, which the investor has to reinvest manually.

- Mutual funds, on the other hand, can either reinvest or pay out dividends, depending on the mutual fund plan (Growth or IDCW). Growth mutual funds reinvest dividends, while IDCWs pay out dividends to the investor’s account.

7. Transparency:

The difference between ETF and mutual fund also includes how transparently they operate.

- Generally, ETFs disclose their holdings daily, so investors can see at any time what securities the fund owns. This transparency helps investors understand their exposure and make informed decisions.

- Mutual funds disclose their full holdings quarterly or monthly. This infrequent disclosure can often leave investors unaware of the securities they own, particularly in actively managed funds where the fund manager frequently changes holdings.

8. Trading Flexibility and Advanced Strategies:

Trading flexibility and the use of advanced strategies highlight another difference between ETF and mutual fund.

- ETFs offer trading flexibility. Since ETFs trade like individual stocks, investors can use advanced trading strategies such as limit orders, short-selling strategies, and stop-loss orders. You can also trade ETFs on margin, subject to the requirements of the broker.

- Mutual funds, on the other hand, do not support these advanced trading features. You can only buy and sell mutual funds at the NAV calculated at the end of the day.

Conclusion:

The difference between ETF and mutual fund encompasses their management style, costs, trading process, accessibility, and tax efficiency. Both are valuable investment vehicles, but they cater to different investor preferences and needs. While ETFs offer lower costs and trading flexibility, mutual funds offer convenient features and benefits such as professional active management.

Your choice between ETFs and mutual funds should align with your investment goals, tax situation, and risk tolerance. Many successful investors incorporate both into their portfolios to take advantage of the unique advantages of each vehicle. Knowing the differences between the two will help you make informed decisions that will help you solidify your long-term financial goals.