Introduction:

Investing in the stock market can be empowering, risky, exciting, and, when done right with the necessary education, financially rewarding. But for beginners, navigating the stock market can sometimes be overwhelming. How do you know where your hard-earned money is safe? How do you separate a potential winner from the vast number of stocks?

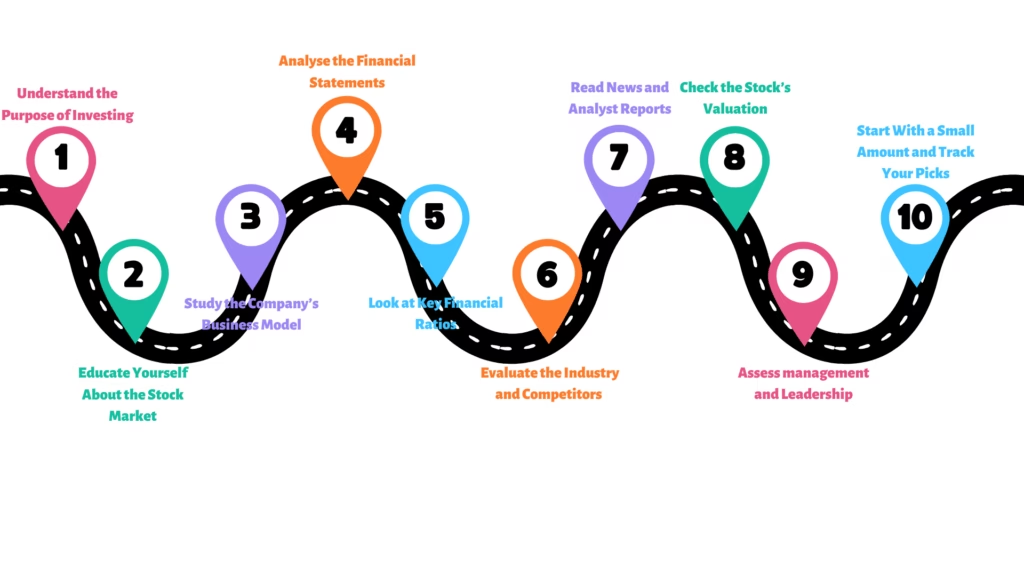

This blog will break down how to pick stocks into 10 easy-to-follow steps. It will teach you the significance of important things like research, analysis, and making informed decisions. Whether you are a beginner or someone looking to sharpen their investing edge, these steps will put you on the path to mastering stock picking.

Table of Contents

1. Understand the Purpose of Investing:

An important step before learning how to pick stocks is to understand why you want to invest. This clarity will influence every decision you make as an investor.

Your investment objective is the purpose behind your entry into the stock market. Lack of a clear objective increases your likelihood of making impulsive or emotional decisions, which can lead to losses. Broadly speaking, investors fall into one or more of the following categories:

Long-Term Wealth Creation:

If you want your money to grow over time, whether it is for a child’s education, retirement, or a home purchase, you will look for strong companies with consistent earnings and growth potential.

Short-Term Gains:

If your goal is quick profits, perhaps through trading or swing trading, you should focus more on technical indicators, market timing, and price action than on finding fundamentally strong companies.

Passive Income:

Some investors aim to generate regular passive income through dividend payments. This type of investor typically invests in companies with a strong track record of dividend payments and are large, stable companies.

Capital Preservation:

If your main goal is to preserve capital while earning a modest return, you would invest in blue-chip stocks.

Let’s understand how your goals affect your stock selection with an example. Suppose two investors, investor A and investor B, are evaluating the same stock:

- Investor A’s goal is to retire in 20 years, and he will look at the company’s long-term growth, future potential, market leadership, and revenue growth.

- Investor B wants to generate a monthly income; he will focus on the dividend yield, payout ratio, and the stability of the company’s earnings.

In this example, although they are looking at the same company, their selection criteria are completely different because their investment goals are different.

2. Educate Yourself About the Stock Market:

Before you can delve into the details of how to pick stocks, it’s crucial that you know how the stock market works. Without this knowledge of the basics, you may feel overwhelmed, make emotional decisions, or fall for the hype that could cost you money.

The stock market is full of terms, concepts, and trends that can seem intimidating at first. But once you get the hang of it, you will be able to see patterns, ask the right questions, and make informed decisions.

You can’t get into the racetrack without learning how to drive a car. Similarly, you shouldn’t invest your hard-earned money without learning the basics of how the market works.

Here are some important, basic, and must-know concepts that you should be familiar with when understanding how to pick stocks:

Stock:

A company’s stock represents partial ownership of that company. When you buy a stock of a company, you become a shareholder of that company.

Stock Market:

In simple terms, a stock market is a market where stocks are bought and sold.

Market Capitalization:

Market capitalization is the total value of a company’s outstanding shares. Based on this, companies are divided into three categories:

- Large-cap (stable and low-risk)

- Mid-cap (growth potential with medium risk)

- Small-cap (high growth, high risk)

Dividend:

Companies pay out a portion of their profits to their shareholders, which is called dividends.

Dividend Yield:

Dividend yield represents the percentage of return a company pays its shareholders on its annual dividends.

Price-to-Earnings Ratio (P/E Ratio):

P/E ratio tells you how much investors are willing to pay for ₹1 of a company’s earnings. P/E ratio is the ratio of the market price per share to its Earnings Per Share (EPS).

Bull Market and Bear Market:

- A bull market represents a market in which the market is rising.

- A bear market represents a market in which the market is falling.

3. Study the Company’s Business Model:

Hopefully, you won’t invest your hard-earned money in a business you don’t understand. A major and important part of how to pick stocks is understanding what the company does and how it makes money. This is known as business model analysis, which forms the foundation of any investment.

Ask simple questions:

- What products or services does the company offer?

- How does the company generate revenue?

- Who are its customers?

- How is it different from its competitors?

Some of the characteristics of a strong business model are that it is easy to understand, scalable, and sustainable. For example, Hindustan Unilever manufactures and sells everyday consumer products that have a consistent demand, strong distribution, and a large customer base, making its business model stable and reliable.

4. Analyse the Financial Statements:

Once you grasp the business model, the next step in learning how to pick stocks is to examine the company’s financial statements. These statements provide a clear picture of the company’s financial health and performance, crucial for making informed investment decisions.

Look at the three main financial statements:

Income Statement:

The income statement reveals a company’s revenue, expenses, profit, and loss over a specific accounting period. Look at the revenue and profit growth over the past 5 to 10 years.

Balance Sheet:

The balance sheet provides a view of a company’s debt, assets, reserves, and shareholders’ equity. The components of a strong balance sheet are low debt, high reserves, and valuable assets.

Cash Flow Statement:

The cash flow statement provides an overview of how cash flows in and out of the business. Positive operating cash flow is a sign of a healthy core business.

You don’t have to be an accountant to get this information, sites like Screener.in and Moneycontrol have now made this type of information much more accessible.

5. Look at Key Financial Ratios:

When you’re learning how to pick stocks to invest in, financial ratios act like a company’s health report. They help you assess profitability, efficiency, and risk.

Here are some important ratios to consider:

Price-to-Earnings Ratio (P/E Ratio):

One of the most important ratios to consider is the P/E ratio. It tells you how much investors are willing to pay for a company’s ₹1 of earnings. A high P/E could mean the stock is overvalued, while a low P/E could mean the stock is undervalued.

Debt-to-Equity Ratio:

The debt-to-equity ratio tells you how much debt a company has compared to its shareholders’ equity. A high value of this ratio may mean the company is at high financial risk.

Return on Equity (ROE):

Another ratio that is very important to look at is ROE. This shows how efficiently a company utilizes its shareholders’ funds to generate profits. A high ROE highlights the good management performance of a company.

Earnings Per Share (EPS):

This represents the portion of profit allocated to each share. Steady growth in EPS is positive.

These ratios help you compare different stocks within the same industry and make an informed investment decision. Mastering these ratios is crucial if you want to make data-driven investment decisions rather than relying on tips or advice.

6. Evaluate the Industry and Competitors:

When you’re learning how to pick stocks, it’s not enough to analyze a company in isolation; you must also analyze the industry that the company is in and how that company compares to its competitors.

The health of an industry significantly affects the performance of all the stocks in that industry. For example, a strong company in a declining industry may struggle, while a weak company in a growing industry may perform well.

Start by doing your research:

- Industry Trend: Is the industry expanding or contracting?

- Market Demand: Are the consumer preferences changing?

- Technological Disruption: Could innovation make the business obsolete?

- Government Policies: Are there any risks or incentives?

Then compare your chosen company to its peers using these metrics, such as market share, revenue growth, leverage margin, and innovation and adaptability.

Comparing a company to its industry context will help you understand whether that company has a long-term future or is facing serious challenges. This will deepen your understanding of how to pick stocks with high potential and low risk.

7. Read News and Analyst Reports:

An essential yet often overlooked aspect of learning how to pick stocks is staying informed about current news and analyst reports. Stock prices rarely move in isolation—they react to related events, market sentiment, earnings reports, and global trends.

Start by following company-specific news, like:

- Quarterly earnings reports.

- Changes in management.

- Launching of new products and services.

- Acquisitions, mergers, and lawsuits.

Reliable sources for this latest news are websites like Moneycontrol, Bloomberg, or The Economic Times. There are also company press releases, or stock market apps with news alerts (e.g., Zerodha or Groww).

Reading analyst reports plays an important role in stock picking and gives you a deeper insight. Analysts use their years of experience and expertise to study companies and offer an overall rating of “Buy,” “Hold,” or “Sell” based on this research.

But you shouldn’t blindly pick stocks based solely on recent news and analyst reports. They only help you verify or challenge your own opinions.

8. Check the Stock’s Valuation:

A great company can be a bad investment when it’s overvalued or when you overpay. That’s why understanding valuation is so important when learning how to pick stocks.

Valuation helps you determine whether a stock is overvalued, fairly valued, or undervalued compared to its intrinsic (real) value. Suppose you go to buy a product, you will not agree to pay ₹2,000 for a product worth ₹1,000.

There are several ways to assess valuation, some of which are mentioned below:

P/E Ratio:

The concept of P/E ratio has been explained earlier. A high P/E may mean that the stock is overvalued.

P/B Ratio:

The P/B ratio compares a stock’s price to its book value. A high P/B ratio may mean the stock is overvalued, while a low P/B ratio may mean the stock is undervalued.

Comparative Valuation:

Comparing the price of a given stock with its peers in the same industry will help you determine whether the stock is overvalued or undervalued.

Let’s understand valuation with the help of an example. Suppose two companies are doing the same thing, but one company’s P/E ratio is lower than the other’s; then the company with the lower P/E ratio may be undervalued and offer more potential for profit.

9. Assess management and Leadership:

When learning how to pick stocks, many people focus only on numbers such as revenue, profit, and ratios. But the key to a successful company is the leadership of that company. The quality of a company’s management affects the long-term growth and stability of that company.

Start by researching the CEO, CFO, and board of directors. Look at their background, experience, and reputation. Additionally, consider management continuity, as frequent leadership changes can signal internal issues.

Observe how management communicates with shareholders by reading documents such as annual reports, earnings calls, and investor presentations.

Another important aspect to consider is corporate governance. How ethically and efficiently the company is run. Finally, review past decisions.

10. Start With a Small Amount and Track Your Picks:

Once you’ve learned the basics of how to pick stocks, it’s time to apply your knowledge. You should always start your investing journey with small amounts. Many beginners make the mistake of investing large sums in a few stocks they’ve picked, only to suffer losses due to a lack of experience and market volatility.

Start with a small investment and track your portfolio regularly. Alternatively, if you want to test your investment strategy without risking real money, you can use a market simulator or virtual trading app.

Keep a stock journal or tracker where you record:

- The stocks you bought.

- Entry and exit points.

- Reasons for choosing the stock.

- Results and lessons learned.

This practice will help you identify your thinking patterns, improve your judgment, and build discipline. Over time, as your stock picking methods become more advanced, your strategy will also become more refined.

Conclusion:

Mastering how to pick stocks isn’t about chasing tips or getting rich overnight. It’s about developing a long-term, thoughtful approach with analysis, self-discipline, and clarity.

The 10 steps we’ve discussed, from setting goals to looking at company financial statements and starting with small amounts and tracking them regularly, are intended to help you invest with purpose and confidence. Following these steps won’t make you rich overnight by making huge profits, but they will greatly reduce your chances of losing money.

The biggest challenge in investing isn’t technical, it’s emotional. The market will go up and down, but if you stick to your process, keep learning, and be disciplined, you will gradually become an investor.

Once you understand how to pick stocks, investing transforms from a gamble to a skill, and ultimately a powerful tool for wealth creation.